Top 3 No-fee Business credit cards for U.S. based wedding filmmakers

Three of the best no-fee business credit cards that can help wedding filmmakers in the United States, especially if you have some large upcoming purchases.

Disclaimer: The following information is NOT to be considered financial advice. It is for informational purposes only. It is also accurate as of the time of this writing.

Please perform your own research and due diligence before making any financial decision.

Lastly, we purposely DON’T use affiliate or referral links. So you can have confidence we are making an impartial analysis free of any conflicts of interest.

Overview

Many wedding filmmakers in the United States may already have one or more business credit cards. However, there are definitely some folks that currently use personal credit or debit cards to make purchases for their wedding film business.

There are no right or wrong solutions here, but rather pros and cons. Ultimately we intend for this information to help you make an informed decision and provide unique insights.

Why get a business credit card?

Great question! A business credit card can make it easier to track your business spending. This can save time when preparing your Federal and State tax returns.

Business credit cards also tend to offer more protections for your business purchases compared to consumer credit cards or debit cards. You can think of extended warranties, damage or loss protection, and fraud protection.

On top of that, business credit cards tend to come with higher signup bonuses.

Apart from a few exceptions, they also don’t report to your personal credit bureaus (i.e. Experian, TransUnion, Equifax). This can be very beneficial when applying for personal credit products as well as maintaining a high credit score.

Am I eligible to get a business credit card?

The term trade or business generally includes any activity carried on for the production of income from selling goods or performing services. As such, your wedding film business can be organized as a Sole Proprietorship, a Limited Liability Company (LLC), an S Corporation, a C Corporation, or a Partnership.

What types of expenses would I put on there?

Another great question! According to the Internal Revenue Service (IRS), business expenses are ordinary and necessary costs incurred to operate your business.

Here are a few common examples for Wedding Filmmakers in the United States:

Buying a new camera or lens

Buying new audio equipment or lighting gear

Cell phone bill used for business purposes

Buying a new computer

Travel related expenses, like gas, Uber, Lyft, flights, hotels, meals, etc

Business use software, such as Honeybook, Adobe, QuickBooks, etc

Website hosting like Squarespace, Wix, etc

Paid advertising on Facebook, Instagram, YouTube, and more

Business license fees / taxes

Business insurance

Considerations

The list below is by no means exhaustive nor meant to cover everyone’s unique needs and wants. Rather, the recommendations are based on having a one and done simple business credit card set-up with no ongoing fees for holding these cards. These are great foundational cards that you can also build upon.

Also, the underlying assumptions are as follows:

You have good credit (i.e FICO score of 670 or greater).

You are able to use credit responsibly. For example, you will pay your balance in full each month or pay your card in full before the intro 0% expires.

You are comfortable managing a separate business account.

Top (3) No-Fee Business credit cards for U.S. based wedding filmmakers

#3. U.S. Bank Triple Cash Rewards VISA Business Card

This is a really solid business credit card. It has no annual fee and offers some solid rewards on common business spending categories.

Earning Categories

3% cash back on:

Gas and EV charging stations

Office supply stores (e.g. Staples, Office Depot, etc)

Cell phone service (e.g. Verizon, AT&T, T-Mobile)

Restaurants & restaurant delivery

5% cash back on prepaid hotels and car rentals booked directly in the U.S. Bank Travel Rewards Center

1% cash back on all other categories

Standard Signup bonus

Earn $500 in cash back by spending $4,500 on the Account Owner’s card in the first 150 days of account opening.

Earn $600 in cash back by spending $4,500 on the Account Owner’s card in the first 150 days of account opening.

Pros

Solid 3% earning categories

Annual $100 statement credit for recurring software subscription expenses such as FreshBooks or QuickBooks

0% introductory interest rate on purchases and balance transfers for the first 15 billing cycles

No limit on the amount of cash back earned. Great perk, especially for the elevated categories.

Eligible for Rewards Center Shopping Deals, to earn more cash rewards.

Long time period (i.e. 5 months) to hit the minimum spend for the signup bonus

Cons

Only 1% on non-elevated categories. This would limit your cash back on large purchases, such as new gear or a computer.

$25 minimum amount to redeem cash back as a statement credit

3% fee for each foreign transaction. Not great if you travel outside of the U.S. for work.

#2. American Express (AMEX) Blue Business Cash Card

Another business credit card worth your attention and consideration. AMEX is known for their excellent customer service. This card has a simple earning structure.

Earning Categories

2% cash back on all purchases, up to $50,000 in spend per year.

1% cash back on all purchases, after $50,000 in spend per year.

Standard Signup bonus

Earn $250 in cash back by spending $3,000 in the first 3 months of account opening.

You may also be eligible for an additional $100 for spending $1,000 on an employee authorized card. You will need to call or chat with AMEX to get this added offer.

Elevated Signup bonus

There are actually two elevated signup bonuses. The first is $500 in cash back by spending $8,000 in the first 3 months of account opening.

The second offer is $500 in cash back by spending $15,000 in the first 12 months of account opening. You can also get $50 in cash back by spending $1,000 on an employee authorized card in the first 12 months.

Pros

Simple set-up to earn 2% cash back on up to $50,000 in purchases each year.

0% introductory interest rate on purchases for the first 12 months

Extended Warranty: Original Manufacturer's Warranty can be extended up to one additional year. Applies to warranties of 5 years or less on Covered Purchases in the United States or its territories or possessions.

Purchase Protection: When you use your Eligible Card for Covered Purchases, your Membership can help protect them if it gets stolen or accidentally damaged up to 90 days from the Covered Purchase date. Up to $1,000 per occurrence, $50,000 per calendar year.

AMEX offers: There are many promotions available throughout the year that offer additional cash back on purchases (e.g. Save $60 when spending $120 or more with Dropbox).

Expanded Buying Power provides the ability to spend beyond your credit limit.

Cons

Shorter time period (i.e. 3 months) to hit the minimum spend for the standard signup bonus

2.7% fee for each foreign transaction. Not great if you travel outside of the U.S. for work.

AMEX is not as widely accepted as VISA or Mastercard. Acceptance is still very high, but you will likely need to carry a second payment method on the VISA or Mastercard network.

Generally you can only earn a signup bonus once per lifetime on this card.

Purchase protection of $1,000 per occurrence might be low for high ticket gear

#1. Chase Ink Business Unlimited card

This card sits at the top of the list for a variety of reasons. It has a great welcome offer, 0% introductory interest rate, as well as the ability to earn Ultimate Rewards points, that can be redeemed for cash, travel and other categories.

Earning Categories

Earn unlimited 1.5% cash back on every purchase

Earn 5% cash back on Lyft rides until March 2025

Standard Signup bonus

Earn $750 in cash back (or 75,000 Ultimate Rewards points) by spending $6,000 in the first 3 months of account opening.

Elevated Signup bonus

Earn $1,200 in cash back (or 120,000 Ultimate Rewards points) by spending $6,000 in the first 3 months of account opening. If you have a large upcoming purchase this could be a huge opportunity.

These offers are available when applying in-branch through a Chase Business Relationship Manager (BRM), or online if you find them in “Just for you” pre-approved offers.

Pros

Simple catch all card earning 1.5% on everything

Huge elevated signup bonus worth at least $1,200

0% introductory interest rate on purchases for the first 12 months

Flexible redemption options for Ultimate Rewards

Purchase Protection: Covers new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Extended Warranty: Extends the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less.

Cons

Shorter time period (i.e. 3 months) to hit the minimum spend for the standard signup bonus

3% fee for each foreign transaction. Not great if you travel outside of the U.S. for work.

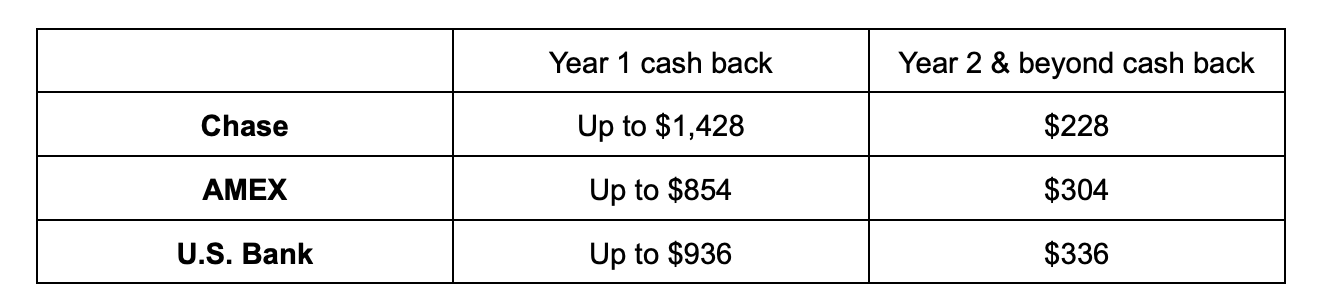

Sample Cash Back Comparison

As an illustrative example, let’s assume your wedding film business has the following estimated expenses each year:

Cell phone $1,200

Gear $5,000

Gas $ 600

Business meals $2,400

Software $3,000

Other $3,000

Total $15,200

Conclusion

You won’t go wrong with any of these business credit cards for your wedding film business. They are all “keeper” cards given their ongoing benefits and $0 annual fee. The main considerations might be the signup bonus, the earning categories, and what financial ecosystem works best for you (e.g. U.S. Bank, AMEX, Chase).

Author Notes

If you found value in this article please drop a comment below and let us know what other topics or deep dives would be most helpful for you.